- MONTHLY PAYMENT FORMULA MATH CALCULATOR PLUS

- MONTHLY PAYMENT FORMULA MATH CALCULATOR FREE

You can make your loan cost less by paying more toward the principal each month, provided there isn’t a prepayment penalty. One way to look at the total interest is as the total cost of borrowing money.

Total Interest: The total interest is how much you’ll pay over the loan term if you make the monthly payments as agreed.

Total Interest: The total interest is how much you’ll pay over the loan term if you make the monthly payments as agreed. While some loans charge a prepayment penalty if you pay more than the amount due each month, many don’t, meaning you are free to increase the monthly payment amount to pay the loan off sooner. Monthly Payment:The monthly payment is how much you need to pay every month to remain on good terms with your lender and up-to-date on your loan.There’s usually a slight difference in how much you pay monthly based on the payment method. Payment Method:The payment method refers to whether the lender uses the start of period or end of period to determine when your loan is due.

A compound rate is based on the amount of the principal plus any interest that has accrued. A simple interest rate is calculated based on the loan principal. It’s a percentage of the total amount you’ve borrowed. Annual Interest Rate:The annual interest rate is the amount a lender charges you for borrowing money.

For example, you have 360 months to repay a 30-year mortgage and 60 months to repay a 5-year personal or auto loan.

Number of Months: The number of months refers to the loan term broken down by the total months you have to repay it. Your income and employment status play a role in determining the size of the loan amount, as do factors such as the collateral and your credit history. Depending on the type of loan, it can be anywhere from a few hundred dollars to hundreds of thousands of dollars. Loan Amount:Also known as the loan principal, this is the amount you’re borrowing. Knowing common loan terminology also gives you a clear picture of how much a loan will cost you in the long run.

When borrowing money, it’s essential to understand the terms a lender will use so you have a clear idea of what you’re borrowing and what your repayment responsibilities are. If you prepay the loan, you’ll end up paying less interest over time and are likely to finish paying it off before the end of the term. Several factors can change your monthly payment amount.

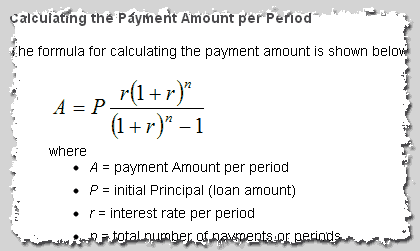

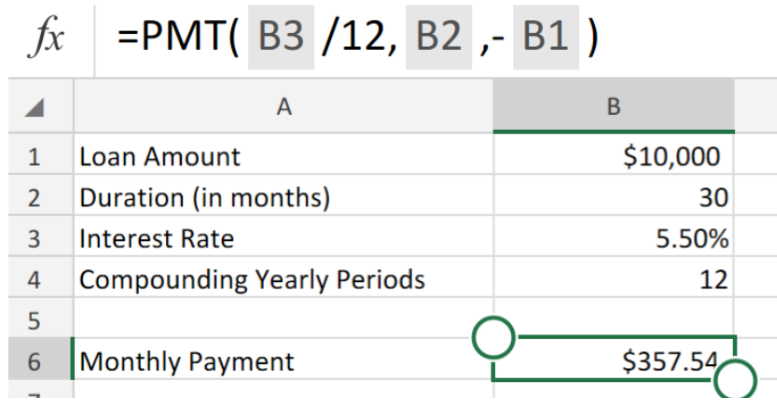

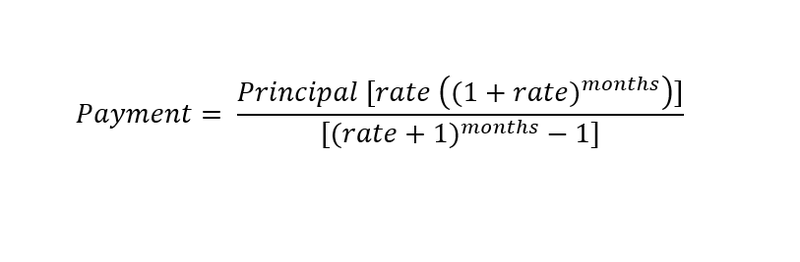

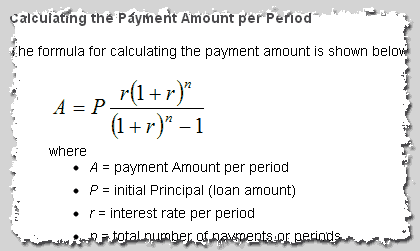

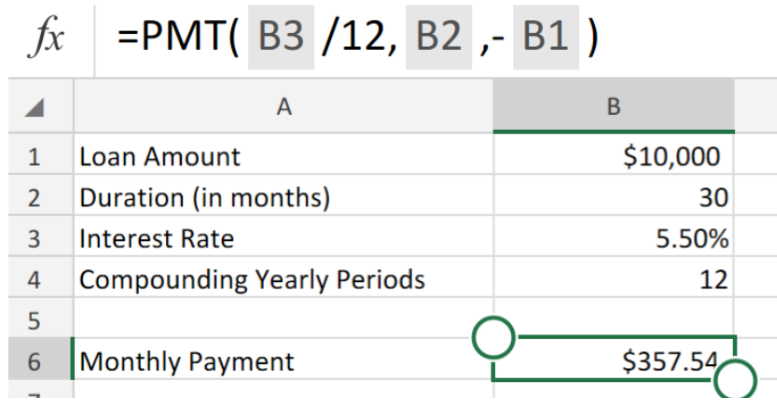

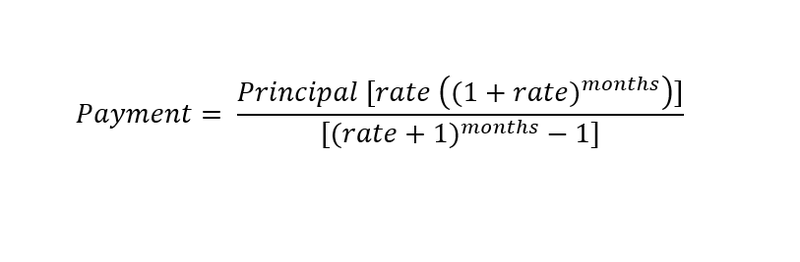

Divide the loan amount by the interest over the life of the loan to calculate your monthly payment. Divide this by 0.006, resulting in 95.31. Add 1 to the interest rate, then take that to the power of 120. Calculate the interest over the life of the loan. Calculate the repayment term in months. If you’re taking out a 10-year loan, the repayment term is 120 months (12*10). If your rate is 5.5%, divide 0.055 by 12 to calculate your monthly interest rate. The more time you have to repay, the more opportunities there are for you to default on it or stop making payments.Ī loan payment calculator can do the math for you, but if you’d like to crunch the numbers yourself to see how much you’ll pay each month, here’s what to do: A lender takes on more risk when giving a borrower more time to repay. Usually, the longer the term, the higher the interest rate. How much you borrow can also influence the interest rate, as do market conditions. For example, $5,000 divided by 30 is $166.66, not $177.95, but added interest will increase your payments.Ī lender determines interest based on several factors, such as the length of the loan and your credit history. Calculating this is a bit more complicated than dividing the loan’s principal by the number of months you have to repay it. Interest, or the cost of borrowing money, also affects the monthly payment. If you borrow $10,000 and take 75 months to repay it (with a 5.50% interest rate), your monthly payment will be $157.14. For example, the payment on a $5,000 loan with a 30-month repayment term (and an interest rate of 5.50%) is $177.95. That said, how long you have to repay the loan also influences your monthly payments. If you borrow $5,000, you’ll most likely have a lower payment than if you borrowed $10,000, assuming you borrow either amount for the same length of time. The amount you borrow plays a critical role in determining the size of your monthly payment.

Several factors influence the monthly payments you make on a loan. A loan calculator can tell you how much you’ll pay monthly based on the size of the loan, the term, and the interest rate. Before you take out any loan, it’s essential to have a clear idea of how long you’ll have to repay it and what your monthly payment will be. Whether you’re looking to buy a house or a car or need some help paying for school, borrowing money can help you reach your goals. Cancel Save changes Loan Calculator to Determine Your Monthly Payment

0 kommentar(er)

0 kommentar(er)